Bombshell Government Report Shows Poorest Americans Pay 53% MORE Under Trump Tax Plan

Could a key government analysis reveal unexpected details about a major tax proposal?

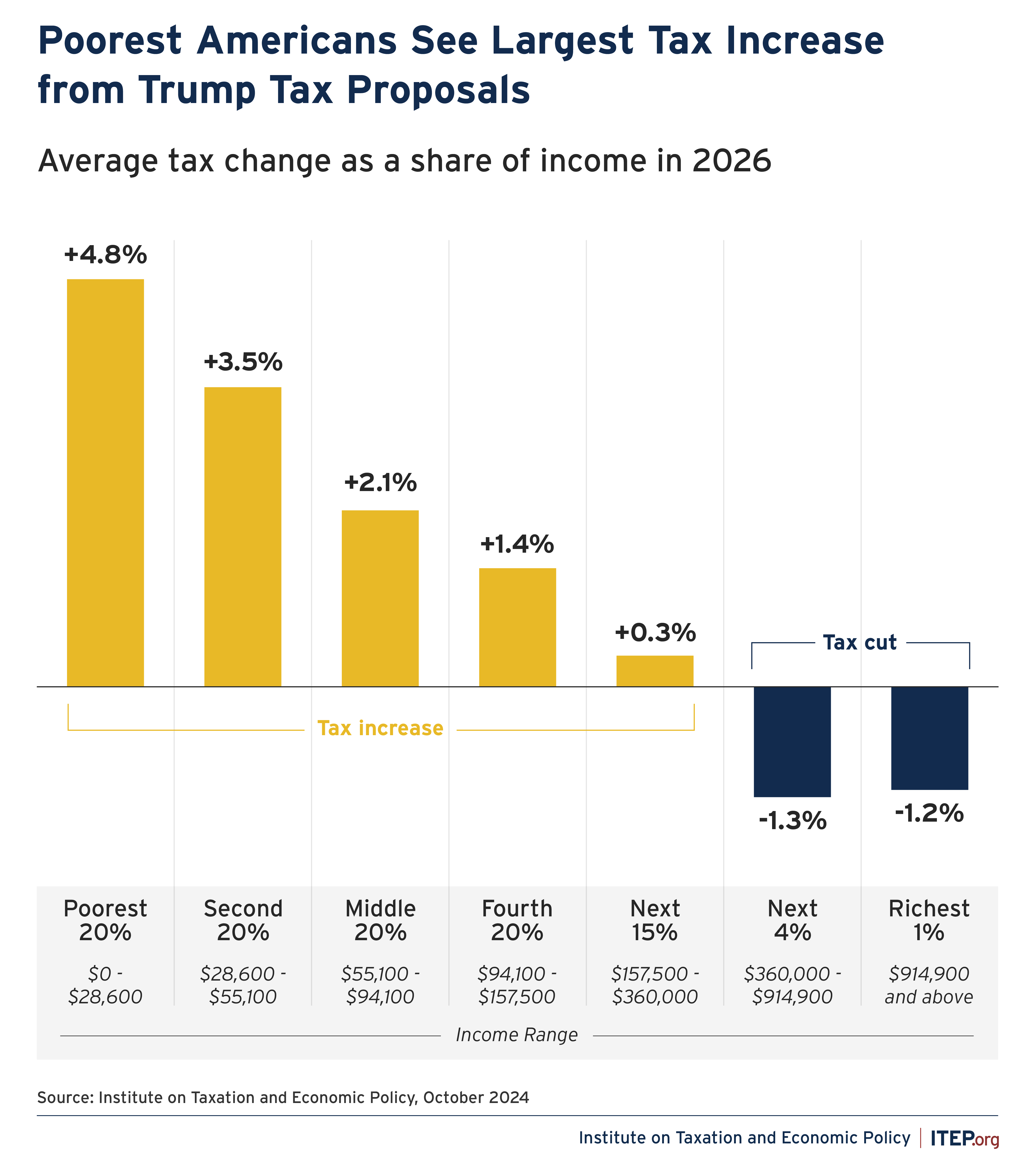

New figures suggest a potential shift in tax burdens for different income brackets under a plan being discussed.

Examining Complex Tax Analysis

Analyzing proposed changes to the nation’s tax code is a complex undertaking.

Various government committees and independent organizations work to project how different income levels might be affected.

These projections often look several years into the future, making their outcomes subject to numerous economic variables.

One such body is the Joint Committee on Taxation (JCT), a nonpartisan group tasked with providing analysis to Congress.

Their reports are frequently cited by policymakers from across the political spectrum to support their arguments.

Differing Views on Economic Impact

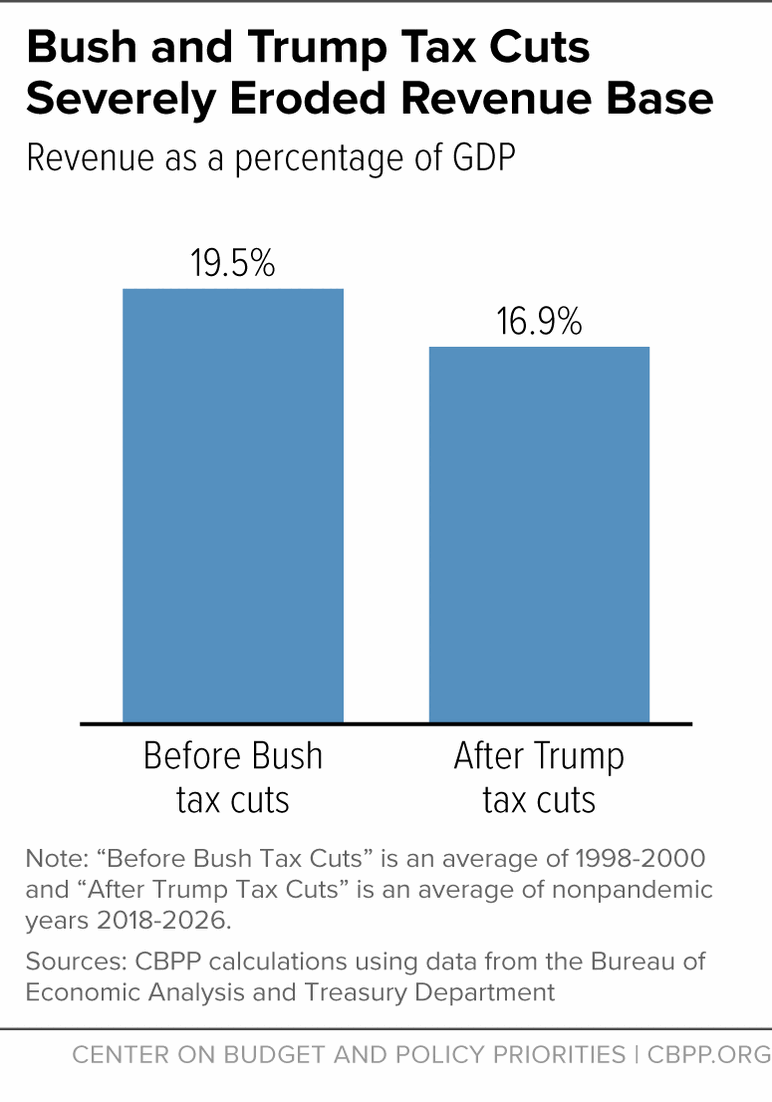

Proponents of tax reforms often argue that lowering rates can stimulate economic growth.

They believe that allowing individuals and businesses to keep more of their income encourages investment, job creation, and overall prosperity.

This “rising tide” effect is seen as potentially benefiting all income levels in the long run.

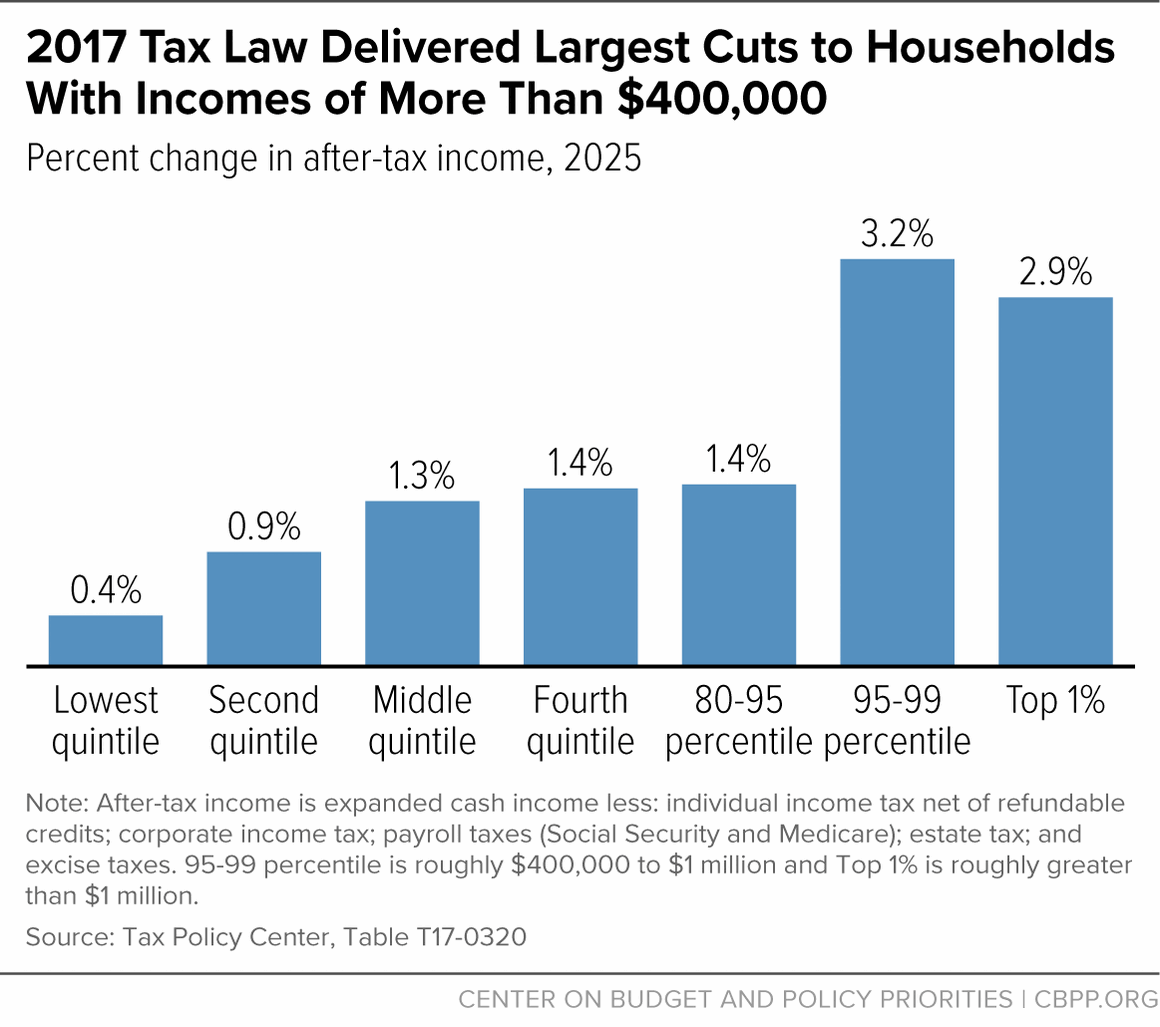

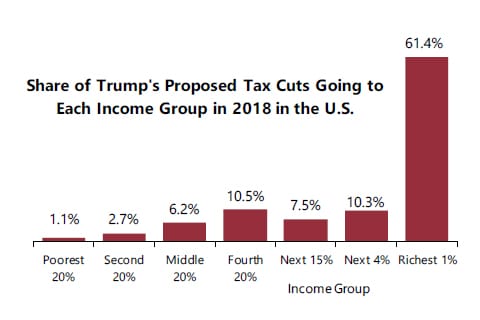

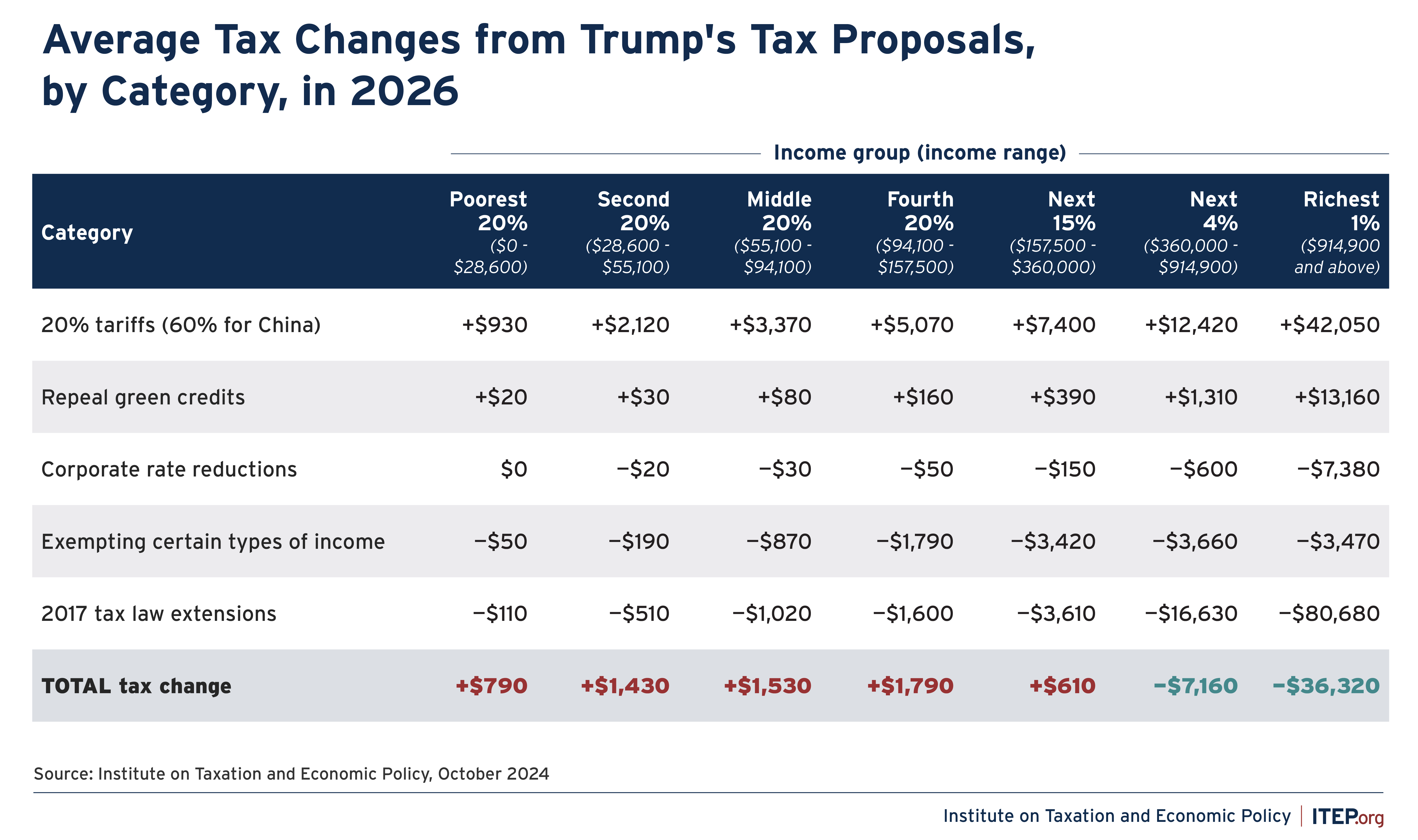

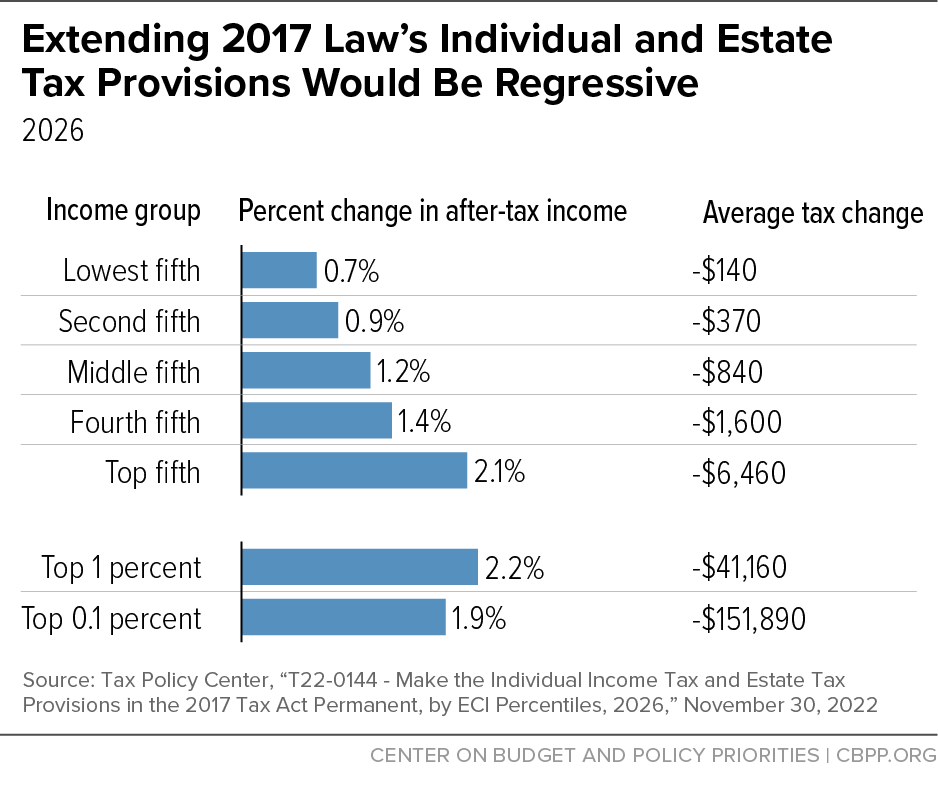

Critics, however, focus more on the immediate, direct impact of rate changes on different groups.

They emphasize distributional tables that show who pays more or less in taxes under a new plan compared to current law.

Navigating Projections and Timeframes

Tax policy discussions often involve projections that extend many years into the future.

These projections can be influenced by the temporary or permanent nature of specific provisions within a bill.

Some provisions might be designed to phase out or change over time, leading to varied impacts in different years.

This means that looking at a single year’s projection may not tell the full story of a plan’s intended long-term effects or average impact over many years.

Focus on Average Earners

Much of the debate around tax proposals centers on how they affect the broad middle class and average earners.

The goal for many policymakers is to reduce the tax burden on these groups to provide financial relief and boost consumer spending.

Official analyses frequently highlight how these large segments of the population are projected to fare under proposed legislation.

Reports often indicate that a significant majority of taxpayers could see a reduction in their tax liability, especially in the initial years of a plan’s implementation.

The Data Point Under Scrutiny

A specific JCT analysis concerning a potential future tax plan has drawn attention.

Focusing on projections for the year 2029, the report indicated differing impacts across income groups.

Specifically, one data point showed that households earning less than $15,000 annually were projected to see an increase in their average tax rate, potentially leading to a 53% higher tax burden compared to current law in that particular year.

The same analysis projected that households earning over $1 million could see a decrease in their average tax rate in 2029.

However, it is crucial to note that the JCT analysis also indicated that, for that same year (2029), Americans making over $30,000 were projected to receive a tax cut under the proposal.

Furthermore, projections for other years, such as 2027, showed different results, with fewer income categories facing increases and larger decreases projected across many brackets.

Analysts point out that the 2029 projection for the lowest bracket is partly due to temporary provisions beneficial to lower and middle incomes potentially expiring, while other provisions might be permanent, altering the distribution over time.

This highlights the importance of considering the full scope of a multi-year analysis and the distinction between temporary and permanent tax code changes.

Understanding the full impact of proposed tax legislation requires looking at a wide range of data, different income levels, and projections across multiple years, acknowledging the complexities of future economic conditions and the design of temporary versus permanent provisions.